While many Americans dream of buying their first home, the reality is the price tag can be a major stumbling block. Even full-time employees taking home a reasonable salary may be shocked at the staggering cost of buying a home in the United States.

People who want to learn how to better manage their finances may be familiar with the website HowMuch. This useful resource recently put together a colorful infographic that shows what salary you need to make in order to afford the average home in each state, and let’s just say you might need to ask your boss for a raise…

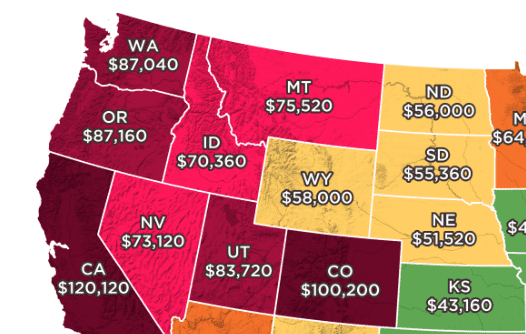

Here is the West Coast:

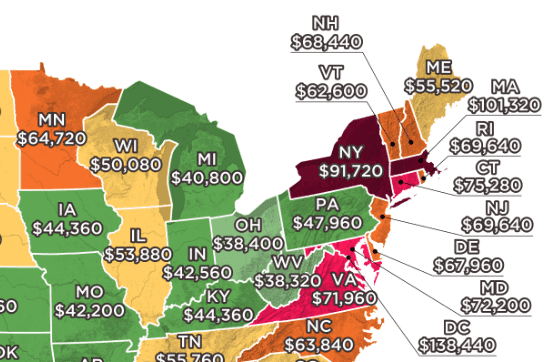

Here is the East Coast:

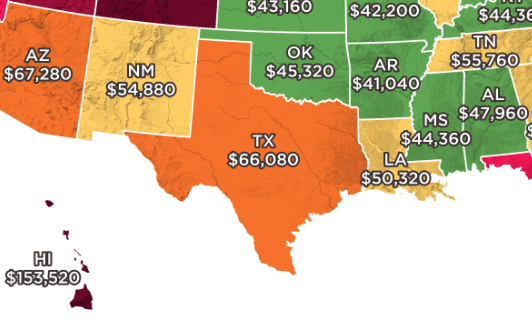

Here is the South:

Though the east and west coasts may have their cultural differences, both share an unfortunate characteristic: expensive homes.

According to the graphic—which factors in a 30-year mortgage with a 10 percent down payment—you would need to make about $120,120 to afford the average home in California.

It doesn’t get much better across the country in Massachusetts, where $101,320 will put you in a position to buy a house.

The situation is not all doom and gloom, though.

For instance, you only need a salary of $47,960 to afford the average home in Pennsylvania. Strangely, midwestern states like North Dakota ($56,000) and Wyoming ($58,000) require a more substantial salary.

Photo Credit: How Much

Of course, the cost-of-living index will vary based on your specific location.

Generally speaking, living in a major city will lead to a more expensive lifestyle, whereas purchasing a home in suburban or rural areas can dramatically lower your cost of living.

So if you’re looking for a home, maybe think a little outside the box. What do you think? Could you afford a home in the state you live in?

Let us know in the comments!