Society today is more credit-based than ever, and good credit is used for a lot more than just getting a loan.

Bad credit can affect whether or not you get approved for a mortgage to buy a home (and/or how high your payments will be) and is also a factor that landlords can use to deny you a lease. It also affects your car payments, ability to start your own business, and may even prevent you from getting a job in some cases as it could indicate poor financial responsibility and/or too much debt for the salary offered.

Photo Credit: Pixabay

What Is Credit?

On the off-chance that you’ve been living in a cave for the last 50 years (or you’re just too young to have to worry about it yet), credit is – very simply – a back-and-forth loan from a bank that you promise to repay at fixed intervals. Unlike a standard loan, where you receive a large lump sum just once, credit allows you to “borrow” money as you need it – up to a certain, pre-determined amount (a.k.a. your credit limit).

As long as you stay regular with your repayments and don’t exceed your credit limit, you could potentially keep using a line of credit forever.

Photo Credit: Pixabay

Credit has existed as a concept for a long time, but really took off with the creation of the first general-use credit card by Bank of America in the late 1950s.

Other competitors such as American Express and Diner’s Club had already introduced credit cards a few years earlier, but these were limited to very specific purchases like dining and travel.

The BankAmericard was usable everywhere, and actually established a lot of the general practices that are still in use today.

Photo Credit: Wikimedia Commons

The first Bank Americard was distributed to 60,000 customers in Fresno, California in 1958. By 1960, there were already a million cards in circulation, and in 1970 they formed an international, interbank card association named Visa (you may have heard of it).

Today, there are roughly 364 million open credit card accounts in the United States alone.

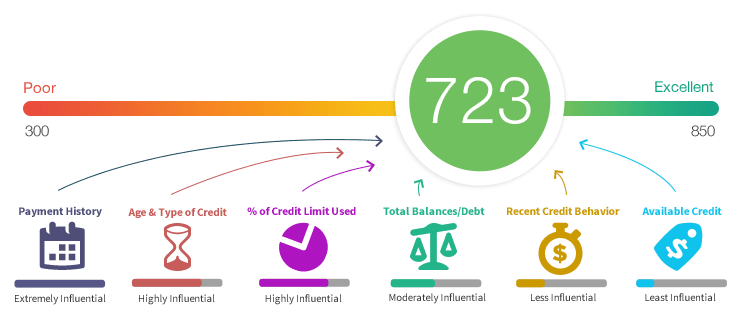

As you use your credit, you start to establish certain patterns – most notably, how much you use and how often you pay it back. These patterns help the banks establish your credit score, which is essentially just how much they trust you to pay them back on time. The better your score, the more likely they are to trust you with larger and larger amounts of credit.

Photo Credit: Quizzle

Unfortunately, because people are people, a lot of folks aren’t so good at paying their debts back on time. The total credit card debt in the United States has surpassed $1 trillion, a problem which is only compounded by the fact that there’s so much misinformation out there. Keeping that in mind, let’s debunk a few of the most commonly-believed myths about credit cards.

1. Checking Your Credit Hurts Your Score

Simply put, no, it doesn’t. However, there is actually a good reason why this myth is so prevalent since there are two types of inquiries into your credit score: hard vs. soft.

A hard inquiry is generally the result of a request by a lender or business to view your full credit report in response to an application for credit, or by a collection agency trying to locate you to settle your debts. These hard inquiries will show up on your credit report and can potentially lower your score – although you do get a break if it happens because you’re shopping for the best rate on things like mortgages or car/student loans.

Photo Credit: Pixabay

A simple inquiry by you to check your own credit score, or one by a prospective employer or other agency as a routine background check, is considered a soft inquiry. This type of inquiry, readily available from a number of sites (with free and paid options) doesn’t affect your score at all. In fact, checking your score regularly can help you make better financial decisions, and even aid in detecting identity theft and fraud.

2. Paying Off Delinquent Accounts Wipes Your Slate Clean

Any account that owes a balance past its payment due date is considered to be a delinquent account. The more often you miss payments, the worse the degree of delinquency is considered to be. Having one or multiple delinquent accounts can negatively affect your credit score, sometimes by over 100 points!

Photo Credit: Pixabay

While paying off your debts definitely helps your credit, clearing a delinquent account doesn’t automatically clear away the negative effects of your account getting to that state in the first place.

For one, it can take time for credit reporting agencies to reflect that you’ve paid off these accounts on your report – it doesn’t always happen automatically, and sometimes may even require you having to contact various reporting agencies and explicitly getting them to update their records.

Additionally, the actual payment information (including how many missed payments there were) can still show up on your credit reports for several years. Depending on the situation, a financial institution may view your late payments as a sign of irresponsibility. The best way to avoid this problem is to try your hardest to stay regular with your payments and keep your balances at a manageable level.

3. You Can/Should Max Out Your Cards As Long As You Pay The Balance Each Month

This is one of those things where the answer is somewhere between yes and no. On the one hand, maxing out your credit is always a very risky thing that will hurt your score more often than not. On the other hand, paying off your debt can help build your credit history, and paying on time is certainly going to help your score.

Many people believe that maxing out your card and then paying it all off every month is good for you.

The truth is a bit more complicated, in large part because your payment date may not match the date your bank reports your balances to credit bureaus – thereby lowering your score in the report instead of seeing the positive effects of you paying it all off. Plus, staying on top of your payments is a lot easier said than done (remember that trillion-dollar debt?), and missing your payments after maxing out is going to do some serious damage.

Photo Credit: Meme Generator

If, however, you are better than most of us at keeping your payment schedule intact, the strategy of maxing out and then repaying before it’s due can be potentially beneficial if you have a particularly favorable rewards system for using your card.

That way, you maximize your rewards without hurting your score – just make sure you know what date your bank reports your balance to the reporting agencies and pay it off before then.

Photo Credit: Money Under 30

4. Bankruptcy Is The End Of The World

If your debt reaches a point where it’s become completely unmanageable, declaring bankruptcy can help adjust or eliminate your debts and get collectors off your back.

However, a lot of people mistakenly feel that declaring bankruptcy is only an option if you’re destitute and it’ll completely ruin your credit (and your ability to obtain credit) for years and years.

Photo Credit: Pixabay

The first thing to remember is that one of the biggest reasons people have to declare bankruptcy in the first place is because of bad credit. More often than not, however, bankruptcy can actually improve your credit score since you don’t have all those outstanding debts weighing you down anymore. Your credit also bounces back relatively quickly after you declare – some applicants see a noticeable uptick in their credit score in under a year.

That said, a bankruptcy will still show up on your file, leaving you to pay higher interest rates on any future lines of credit and start off with lower limits than you had before. You will, however, still be able to obtain credit in general and also don’t have to give up major assets like your home or car, provided you’re making payments on time.

Photo Credit: Pixabay

Just remember that although there is absolutely life after bankruptcy, declaring can be a tricky process and having an attorney to assist is definitely recommended.

While it’s certainly not a requirement, even just a few consultations can save you a world of trouble.