Trending Now

For some people, the world and morality are black and white. Things are wrong or not, moral or not, and there’s no wiggle room or space to negotiate in the middle. For other people, the world is more gray, and whether or not something is wrong can depend on who you’re dealing with, and maybe whether or not their actions mean they “deserve” what’s coming to them.

For this man, who worked at a very successful tech company back during the boom, his bosses attitude and ineptitude seemed like reason enough to rip him off for more than $1M.

He started with the company right out of college and worked his way up to have some face time with the owners, but was always careful to stay in his own lane – which had nothing to do with buying or selling stocks.

BACKGROUND:

A year out of school in the early-1990’s, I procured a job as a business analyst for a large, family-owned tech company. This business was located in the booming heart of technology at the time and was very profitable. As tech took off over the next decade, the company thrived and remained family-owned. What was a rich family and company became exceedingly wealthy with a valuation/net worth in the high 9/low 10-figures.

The family that owned it was quite neurotic, very moody and had a reputation as very ruthless (greedy) when it came to financing, deal-making, employees, etc. I truly believe this is what held them back from ultimately becoming a household name as a company.

As I progressed in the company, I gained more and more face time with the owners. I worked on some projects directly with ownership that really paid off and gained me even greater access to their inner circle. Now, like a lot of people at the time and particularly those who worked in tech, I was heavily invested in tech stocks. I discussed some of my investments and gains with ownership as casual conversation, though investing had nothing to do with my role in the company.

But when one of the owners asked him if he would invest some of his (and the company’s) money for him, the guy jumped at the chance to pad his resume.

He was smart enough to ask for the details of the arrangement in writing, and carried on.

That is until one day in late-1999 when the owner came to me and asked me if I would invest some of his personal money. He wanted me to take big risks to see if they would pay off using 1 million dollars of his personal money. I was a bit hesitant, but still being in my late-20’s and wanting to prove myself, I said I would.

I asked for a written agreement where they acknowledged this wasn’t my role in the company, was a personal matter between the owner and me, and to document my compensation for this side arrangement (20% of all profits).

He went to work, dealing mostly in short sales, where he was comfortable at the time, and after a short while, was showing profits in both his and his boss’s accounts.

Around this same time and by working in the industry I started to notice the weakness associated with a lot of tech companies. They just weren’t living up to their hype and stock price and some seemed like they were starting to run out of money. I had no inside information, just a strong sense of which companies were struggling based on my work in the business.

Based on this sense I started using both my money and the owners money to short tech companies just after the New Year in 2000. For anyone unfamiliar with shorting, it means if the value of a stock decreases, the value of the investment increases. I had a few long positions, but my overall position was very short.

Since the owner wanted big risk and big reward, I used his money and obtained leverage or margin from the financial institution where I maintained both his and my trading accounts. The accounts were separate, but both under my name (again, I documented this and gained consent).

Well, both my account and his suffered some moderate losses in the first two months of 2000 before the bubble began to burst and both accounts, but his in particular, began to skyrocket.

When the company started to struggle financially, the boss who had invested came to OP to ask him how the accounts were doing. He told him they had netted around $1.35M so far but that there were also some open accounts that were worth around $1M.

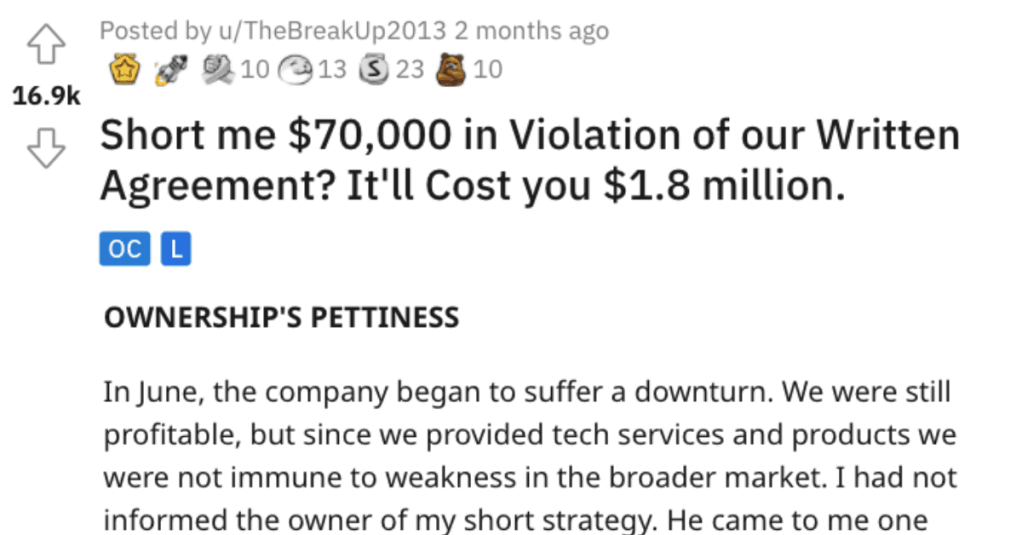

OWNERSHIP’S PETTINESS

In June, the company began to suffer a downturn. We were still profitable, but since we provided tech services and products we were not immune to weakness in the broader market.

I had not informed the owner of my short strategy. He came to me one day and asked how his money was doing, saying he suspected it was way down like the general market. To his surprise, I informed him that while we still had some money tied up in options (puts) and shorts, but based on the positions I had closed, there was $1.35 million in cash sitting in the account that belonged to him.

Again, I still had a bunch of open positions which, if memory serves, were worth about a million on that date, but the positions I had closed had yielded $1.35 million in cash just sitting in his account (which was in my name).

The owner asked for the $1.35M out, and got angry at OP for asking for the 20% they’d agreed on – around $70K.

The owner, either through ignorance or lack of attention, said “Great, $1.35 million. Fantastic work in this down market. Will you please wire it to me?” I responded that I would, but would be taking my 20% of the $350,000 profit, or $70,000, before wiring him the $280,000. I also reminded him I still had open positions that had yet to pay off or close, but I didn’t state the amount. He, once again, appeared not to understand or comprehend the open positions statement, but instead totally focused on and became incensed about my rightful claim for $70,000. He went on and on about how times were tough, I should be grateful for a job, particularly at my young age, and the entire $350,000 was necessary for him and the company. I knew this wasn’t true based on my position within the company. Worse, this was my first time personally experiencing the greedy and corrupt nature that served as the basis for ownership’s reputation.

Which is when OP decided to go ahead and take his revenge for those wrongs.

Revenge that netted him around $1.8M.

THE REVENGE

Now comes the revenge. Since, after two separate conversations, the owner didn’t seem to grasp that the open positions would yield at least some income, and thus additional profit, I decided not to mention it again. I sent him back the entire $1.35 million and continued to manage the open positions to the best of my ability. And here’s the kicker, the owner never brought it up again. He seemed to think the $1.35 million payment was the entire value of the account and never understood or remembered that open positions still existed. He never asked for records, tax documents or any time of audit or financials. Given the fact that he was dishonest with me, I didn’t feel the need to disabuse him of that notion.

Ultimately, after a bit more net gain, I covered all of the shorts and exercised all of the options (puts in this case) for an additional $1.8 million. I worked for the company for 3 more years and owner never asked about it during my tenure, after I gave notice, or since. I know it’s a bit crass and even shady af, but given his dishonesty with me over the $70,000, I felt justified in keeping the additional $1.8 million. I paid taxes on the gain (long term cap gain), and went on my way with a fantastic nest egg. Nobody has asked about it since and I have only told the story to a few people (and even then only after the statute of limitations passed).

He waited and saved the money during the rest of his time with the company, and then for a few years after he left, but no one ever asked for it.

The owners are all deceased now and he feels pretty smug at having swindled some arrogant and clueless people out of a whollllle lot of money.

The final ironic cherry on top of this sundae is that during my remaining 3 years I gained greater influence with ownership in position within the company because they considered me loyal for giving the $1.35 million back and not making too much of a stink about the $70,000 profit.

Little did they know I got the better of them. The company eventually folded due to family disputes, but my understanding is that ownership walked away in very good financial position.

They likely could have been a much better and greater company had they not practiced the same dishonesty that they showed me with their vendors, clients and employees.

Thanks for reading and hope you enjoyed.

I don’t know how I feel about this, y’all. I’m not stodgy or anything but this feels a loooootttt like stealing.

Drop your opinions in the comments!